No-Cost Ownership Program

No-Cost Ownership Program

No-Cost Ownership for Landmark Clients

Healthcare providers that choose Landmark’s No-Cost Ownership Program receive significant no-cost ownership interests in their new outpatient buildings from Landmark.

Financial Benefits for Landmark’s No-Cost Ownership Clients

Program participants receive a significant percentage of the cash flow from the operation of their new outpatient buildings

Program participants receive a significant percentage of the net proceeds that are realized from future refinancing.

Program participants receive a significant percentage of the net proceeds that are realized from and eventual sale.

No-Cost Ownership Without Risk or Investment

No Front-End Risk Capital

No Equity Investment

No Debt Financing Guarantees

No Cash Calls

Additional No-Cost Ownership Information

For the outpatient buildings that are developed under Landmarks no-cost ownership program, Landmark owns the portion of the buildings that are not included in the no-cost ownership interests healthcare providers receive from Landmark. The financial obligations of the healthcare providers that choose Landmark’s No-Cost Ownership Program are limited to the execution of 15-year leases for their space in their new outpatient buildings.

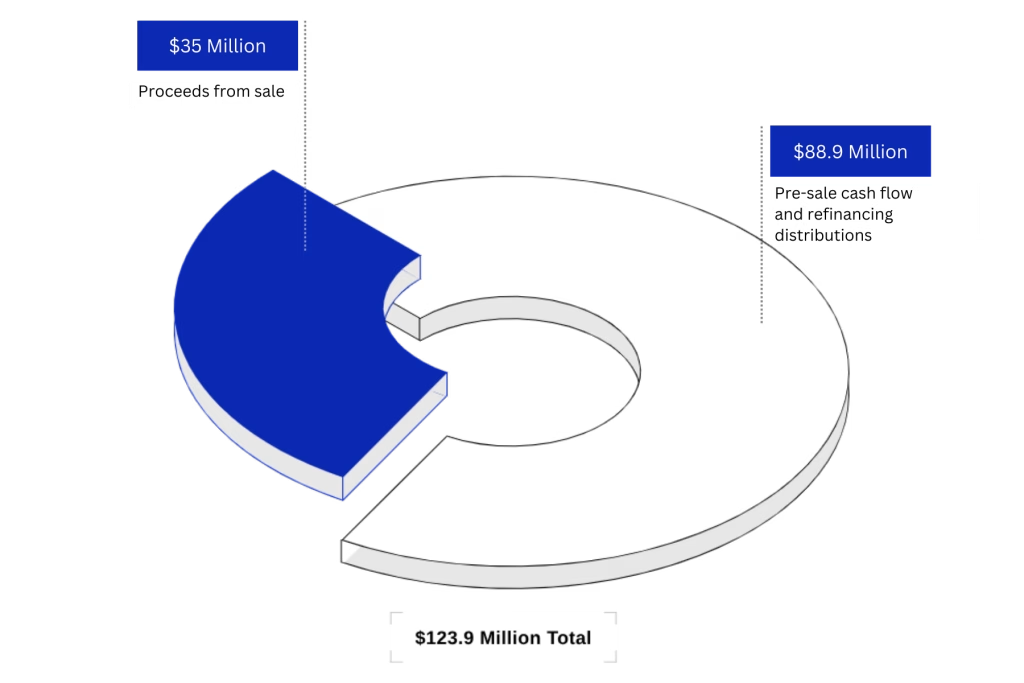

$123.9 Million Distribution to 13 No-Cost Ownership Clients

Landmark and nine healthcare providers that chose Landmark to develop 13 outpatient buildings under Landmark’s No-Cost Ownership Program sold the 13 buildings December, 2021.

Landmark distributed $123.9 million to the nine healthcare providers that participated in the sale of the 13 outpatient buildings, an average distribution of $9.5 million per building.

Of the $123.9 million distribution, $88.9 million were net proceeds from the sale of the 13 outpatient buildings and $35 million were net proceeds from cash flow and refinancing distributions prior to the sale.

Have Questions?

For additional information about the No-Cost Ownership Program of Landmark,

please contact us online or call us at 414-277-0500.